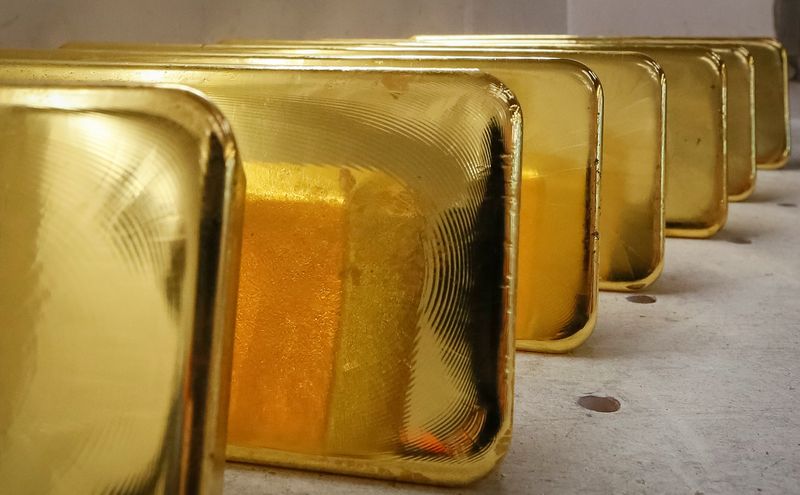

Investing.com– Gold prices steadied in Asian trade on Thursday after surging close to record highs in the prior session after the Federal Reserve flagged the possibility of an interest rate cut in September.

The yellow metal also saw increased safe haven demand amid heightened concerns over a bigger war in the Middle East, after the killing of Hamas leader Ismail Haniyeh in Tehran.

steadied at $2,446.41 an ounce, while expiring in December rose 0.7% to $2,490.15 an ounce by 01:26 ET (05:26 GMT).

Rate cut hopes buoy gold prices

Bullion prices rose sharply on Wednesday, coming close to a record high of $2,483.78 an ounce after the Fed , as widely expected.

But Fed Chair Jerome Powell flagged more progress towards lower inflation and a cooling labor market, and explicitly raised the possibility of a September rate cut on more encouraging data.

While the Fed still has some more inflation and labor market readings to contend with before its next meeting, markets were seen almost entirely pricing in a 25 basis point cut in September, showed.

Lower rates bode well for gold, given that they reduce the opportunity cost of investing in non-yielding assets. Focus this week is also on key data for July, due on Friday.

Other precious metals were mixed, but retained most of their gains from Wednesday. fell 0.2% to $984.40 an ounce, while rose 0.5% to $29.070 an ounce.

Copper rebound stalls on more negative China data

Industrial metals, however, performed less favorably than their peers, with a rebound in copper prices stalling after more weak economic signals from top copper importer China.

Benchmark on the London Metal Exchange rose 0.2% to $9,243.50 a tonne, while one-month fell 0.3% to $4.1833 a pound.

Purchasing managers index data from China pointed to a broad slowdown in manufacturing activity. data showed an unexpected contraction in the sector through July, coming in line with a from Wednesday.

The Caixin data served as a pain point for sentiment towards China, given that the reading has usually painted a more favorable picture of the economy than the government PMI.

Copper prices had rebounded from over five-month lows on Wednesday on some encouraging comments from Beijing, while the weak PMI data also drove up hopes for more stimulus measures. But Thursday’s reading indicated that the government would likely have to do much more to support the economy.

Read the full article here