Vice President Kamala Harris’ tax plan could cost the U.S. economy nearly 800,000 jobs, a new analysis by the Tax Foundation finds.

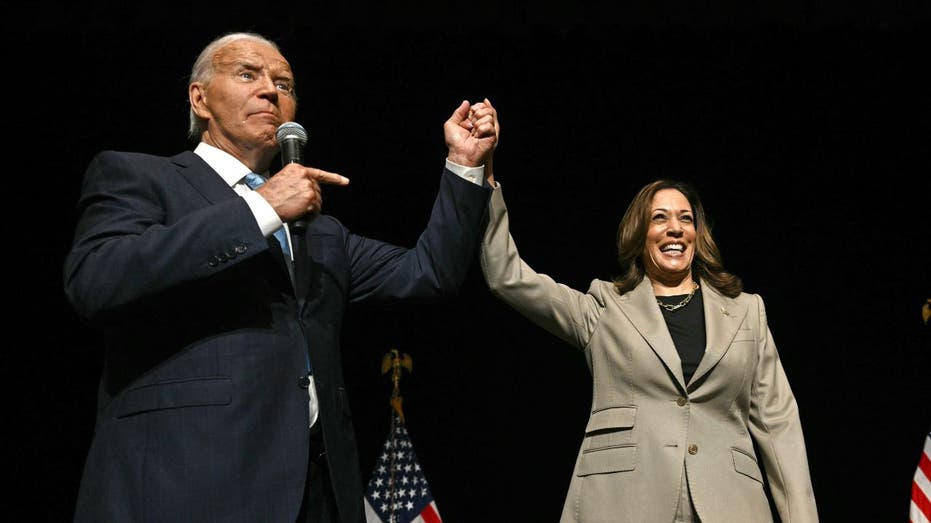

Harris’ tax plan, which contains a variety of tax increases, cuts and credits, is based largely on President Biden’s budget – though the vice president has offered her own policy ideas since becoming the Democratic presidential nominee.

Overall, the Tax Foundation analysis finds a loss of 786,000 full-time equivalent jobs over the long run under Harris’ plan when compared to baseline projections, as well as 2% decline in long-run GDP and a 1.2% dip in long-run wages, while bringing in nearly $1.7 trillion in additional tax revenue over the next decade.

“Similar to the president’s proposals, we find that it would reduce the long-term growth of the economy, it would reduce American incomes relative to where they would otherwise be, and it would lose, rounding up, close to 800,000 jobs in the long-run,” Garrett Watson, senior policy analyst and modeling manager at the Tax Foundation, told FOX Business in an interview.

POLICY GROUP SAYS HARRIS’ SMALL BUSINESS BREAK GETS DROWNED OUT BY OTHER HIGHER TAXES

“That’s mostly from both disincentives for work under her plan and for investment, which produces higher incomes and creates jobs,” Watson said.

Some of the tax policies Harris has outlined to date would have a larger impact on the labor market than others.

Raising the net investment tax from 3.8% to 5% and hiking the additional Medicare tax from 0.9% to 2.1% would cost 177,000 jobs. Those combined policies would have the largest negative impact on the labor market of the policies in the Tax Foundation’s analysis, and would also reduce gross domestic product (GDP) by 0.5%.

TRUMP, HARRIS TAX PLANS COULD WEIGH ON US ECONOMY, ANALYSIS SHOWS

Harris’ plan would also make permanent the American Rescue Plan Act’s expansion of the Earned Income Tax Credit (EITC) and permanently revive that law’s child tax credit (CTC), as well as increasing the CTC for newborns to $6,000. Those policies would have a combined net cost of 131,000 jobs, according to the report.

Increasing the corporate tax rate from its current level of 21% to Harris’ preferred rate of 28% would cost 125,000 jobs. It would also have the largest impact on GDP of the policies outlined, reducing it by 0.6% over the long run.

Raising the top tax rate on individual income to 39.6% for those earning $400,000 as individual filers or $450,000 as joint filers would cost 86,000 jobs.

CHAMBER OF COMMERCE RELEASES TAX POLICY PRIORITIES AHEAD OF ELECTION

Taxing unrealized capital gains of more than $5 million at death (or $10 million for joint filers), and taxing capital gains over $1 million at a 28% rate would cost 75,000 jobs, as well as reducing GDP by 0.2% over the long run.

Just one of the policies in the analysis showed a net positive gain in jobs. Exempting tips from federal income taxes would add about 21,000. Notably, the policy is one area where she agrees with her electoral rival, former President Trump, who proposed the policy before Harris incorporated it into her platform.

FOX Business reached out to Harris’ campaign for comment.

The Harris campaign has pointed out the Tax Foundation’s analysis of Trump’s plan to implement a universal tariff on all goods of 10% and increase tariffs on China to 60% would cost 674,000 jobs as well as reduce GDP by 0.8% over the long run. He has also proposed a universal tariff increase to 20%, which would cost 402,000 jobs.

Though other Trump policies would create jobs, such as making the Tax Cuts and Jobs Act’s policy changes permanent for individuals (+792,000 jobs) and businesses (+115,000 jobs), the tariffs and foreign retaliation against them (-362,000 jobs) would lead to a net cost of 387,000 jobs, according to the Tax Foundation’s analysis.

Read the full article here