Consumers are spending 38% less on excessive or “guilt tipping” in 2025 compared to a year earlier, as rising living costs force them to scale back, new research shows.

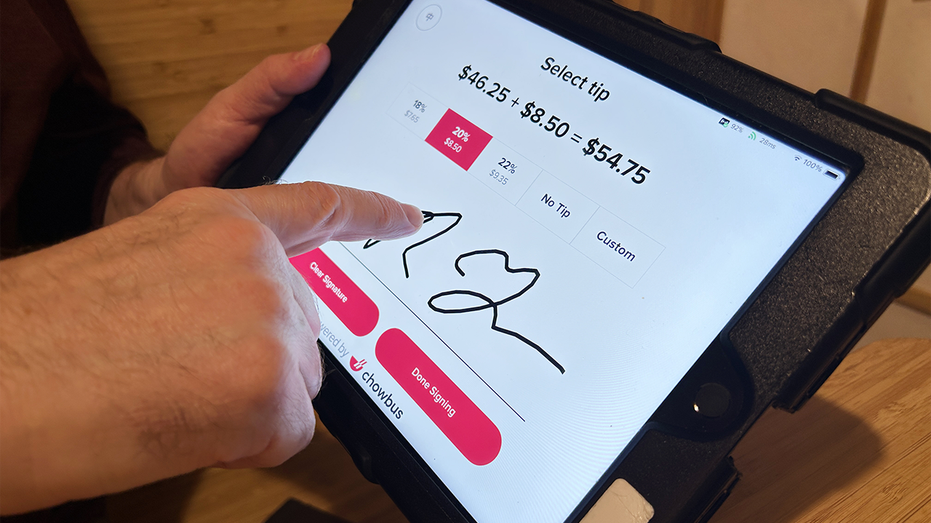

The term “guilt tipping” was coined to refer to the social pressure or discomfort a customer feels when they are asked to leave a tip, often through digital point-of-sale (POS) systems. Rather than using tipping purely as a voluntary reward for good service, people have felt compelled to do so out of guilt or fear of judgment.

In fact, the average person reluctantly tips $24 per month more than they feel is fair due to the pressure or awkwardness of not doing so, according to findings from Talker Research’s yearly study.

AMERICANS ARE ANNOYED WITH ‘TIPPING CULTURE’ AND ARE LEAVING FEWER GRATUITIES

The research shows that the cost of guilt tipping adds up to $283 over the course of a year, according to the study, which explored 2,000 people’s approaches to tipping.

Still, that figure is significantly lower than a year ago when American consumers spent over $450 on guilt tips, suggesting that the public is resisting pressure to excessively tip. Respondents admitted in the latest study that they tipped out of guilt 4.2 times per month on average, versus the 6.3 times reported a year earlier in Talker Research’s 2024 findings.

STATES WHERE PEOPLE GIVE THE BIGGEST TIPS

About 20% of those people say they always or often tip higher because they feel pressured or guilty, though 29% say they never or rarely feel this way.

Additionally, 37% of those surveyed noticed that tipping options have are higher than they used to be. Nearly half of the respondents already noticed this trend last year.

TREASURY DEPARTMENT RELEASES OFFICIAL LIST OF JOBS ELIGIBLE FOR ‘NO TAX ON TIPS’ DEDUCTION

Nearly half of the respondents agreed that higher living expenses had caused them to pull back on tipping. Over a fifth say they now tip less across the board and a majority believe that businesses should pay employees more over relying on tips.

About only 11% admitted that their tipping increased. Of those tipping more, nearly half say it’s due to the desire to support workers.

However, the results come right after the One Big Beautiful Bill Act (OBBBA), was signed into law on July 4, allowing eligible tipped workers to deduct up to $25,000 in tips from their taxable income. This will take effect from 2025 through 2028, unless extended, and will apply to over 60 jobs, organized into eight categories.

Among those jobs are bartenders, wait staff, dishwashers, food servers in non-restaurant settings, cafeteria attendants, cooks, bakers, food preparation workers, and hosts — positions that often rely heavily on tips.

Read the full article here