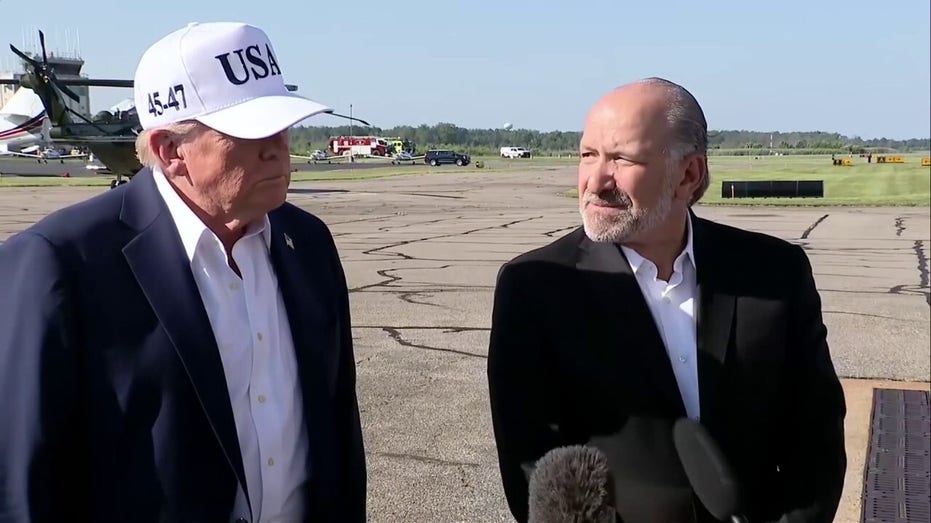

FIRST ON FOX: More than 30 conservative organizations sent a letter to Commerce Secretary Howard Lutnick on Tuesday rejecting the Trump administration’s reported plan to impose a new patent tax.

Americans for Tax Reform, Conservatives for Property Rights and the National Taxpayers Union are among the conservative watchdogs and policy groups leading the coalition against the “unprecedented change being considered for the U.S. patent system.”

According to The Wall Street Journal, Lutnick has discussed charging patent holders 1% to 5% of their overall patent value. That would dramatically increase fees to shore up revenue to pay for the government’s budget deficit.

In a letter addressed to Lutnick, the conservative organizations argue that a new patent tax would undermine the tax cut benefits included in President Donald Trump’s One Big Beautiful Bill Act, which narrowly passed through Congress earlier this year.

TARIFF UNCERTAINTY THREATENS $490B IN US MANUFACTURING INVESTMENT, REPORT WARNS

The organizations describe the tax as “counterproductive in the extreme” and “fraught with peril and unintended consequences.” They argue that raising revenue for the federal government is in stark contrast to the “user-fee-based patent system in existence today, one which funds its operations from a dedicated revenue stream.”

TRUMP’S TARIFF POWER GRAB BARRELS TOWARD SUPREME COURT

James Edwards, Founder and Executive Director of Conservatives for Property Rights, called the floated plan a “tax on American innovation” that “certainly isn’t conservative policy” in a statement to Fox News Digital.

“It radically departs from the successful, 200-plus-year American patent system. Creating a patent tax that leeches on American innovators will backfire. It will disincentivize investment in and invention of the most highly valuable technologies and drain funds that would go into a company’s research and development,” Edwards added.

The Conservatives for Property Rights leader called it “bad tax policy, bad innovation policy, bad competitiveness policy, and government encroachment on private property rights.”

The coalition of conservative organizations laid out five key disagreements with the patent tax in the letter to Lutnick.

First, they said it would undermine the tax cut benefits in Trump’s One Big Beautiful Bill, driving venture capital away from the United States. Second, the leaders said the tax would diminish American global leadership, threatening jobs and domestic investments.

Third, the organizations argued that assigning value to a patent could halt its long-term success and resemble a wealth tax. Fourth, they argue only Congress can impose a tax.

Fifth and finally, the conservative coalition argues a patent tax “would directly jeopardize the United States’ position in the global race for innovation leadership.” They say the risk is greatest in emerging technologies, including semiconductors, medicine, quantum computing, artificial intelligence, energy, advanced materials, aeronautics and national security.

Appealing to Lutnick directly “as an inventor,” the conservative leaders argue that a “patent merely secures exclusive private property rights that inherently belong to the inventor” and ensures “the patent owner’s unfettered opportunity to commercialize and profit from the time and effort invested in the creative pursuit.”

“Lower taxes and more prolific innovation enable our nation to outcompete China and other foreign competitors,” the coalition said, arguing that “economic freedom is the course of innovative dynamism and success.”

The conservative leaders also cite the president’s son, Donald Trump Jr., who wrote in a Daily Caller opinion article that patent law allows “those who dream big and work hard to reap the rewards of their effort, and to foster innovation in a capitalist system.”

“Those words could not be more relevant and powerful today. Therefore, we strongly urge the Department of Commerce to drop any further consideration of a patent tax and, instead, allow the salutary effects of the President’s OBBBA to take root,” they conclude.

In a statement to Fox News Digital, Pete Sepp, President of National Taxpayers Union & NTU Foundation, said, “The last thing the Administration should be considering is a proposal that takes a page from the Left’s playbook on wealth taxes.”

He argues the tax would be “highly complex to administer, costly to comply with, and fundamentally punitive toward successful innovation.”

“The American Dream faces too many obstacles from government already; a new nightmare of a tax will only make matters worse,” Sepp said.

Fox News Digital has reached out to the White House for comment.

Read the full article here