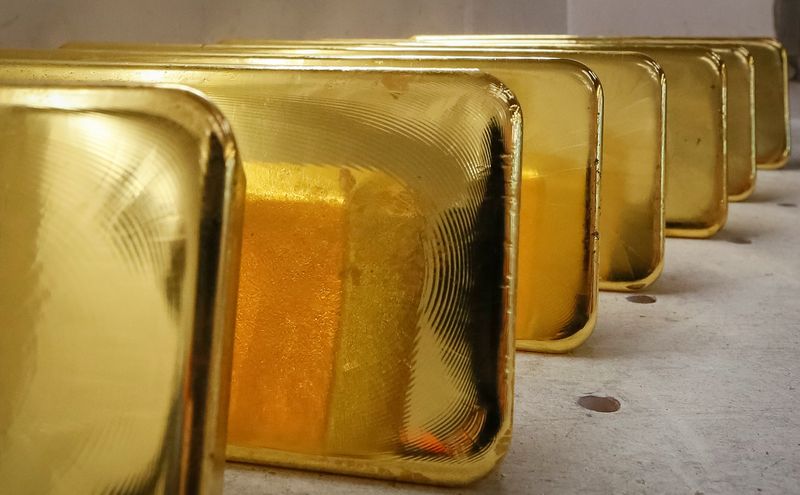

Investing.com– Gold prices fell slightly in Asian trade on Wednesday, but remained in sight of a record high as traders positioned for signs of easing consumer inflation after a soft reading on producer inflation.

The dollar came close to eight-month lows after a soft inflation reading on Tuesday, benefiting most metal prices. But further gains in metal markets were held back by some caution before Wednesday’s consumer price index reading.

fell 0.2% to $2,461.11 an ounce, while expiring in December fell 0.3% to $2,500.40 an ounce by 00:43 ET (04:43 GMT).

Gold keeps record high in sight as CPI approaches

Gold futures hit record highs this week, while spot prices were in sight of a $2,483.78 record high.

Gains in the yellow metal came as soft inflation data on Tuesday furthered bets that the Federal Reserve will cut interest rates by 50 basis points in September, although markets were still pricing in the potential for a 25 bps cut.

The softer PPI reading ramped up hopes that due later on Wednesday will also show inflation fell in July.

Lower interest rates bode well for the yellow metal, given that they reduce the opportunity cost of investing in non-yielding assets.

Gold also saw increased safe haven demand this week after reports suggested that Iran was planning to strike back against Israel over the killing of a Hamas leader in Tehran earlier in August. Overnight reports said Hamas had launched some rockets on Tel Aviv.

Other precious metals were mixed on Wednesday. fell 0.7% to $939.95 an ounce, while rose 0.2% to $27.832 an ounce.

Copper sees some gains on supply disruption fears

Among industrial metals, copper prices fell on Wednesday, but recovered some lost ground in recent sessions after a major union strike at BHP’s Escondida mine in Chile, which accounts for nearly 5% of global copper supplies.

Production was crimped at the mine, with any chances of an extended strike presenting a supply shortfall for copper markets.

Copper prices had risen sharply in 2017 after the union held a 44-day strike- its longest one yet.

Benchmark on the London Metal Exchange fell 0.2% to $8,963.0 a ton, while one-month fell 0.4% to $4.0450 a pound.

Both contracts clocked some gains this week after concerns over Chinese demand saw copper prices slump to a four-month low.

More economic cues from China are due on Thursday, with and data on tap.

Read the full article here