Democratic presidential nominee and Vice President Kamala Harris is calling for increasing the capital gains tax for high earners to 28%, a much smaller increase than the nearly 40% top rate President Biden previously proposed.

Harris revealed the plan in a speech on Wednesday in New Hampshire, telling the audience, “If you earn a million dollars a year or more, the tax rate on your long-term capital gains will be 28 percent under my plan, because we know when the government encourages investment, it leads to broad-based economic growth, and it creates jobs, which makes our economy stronger.”

TRUMP VOWS TO CUT BUSINESS TAX RATE TO 15%, CREATE GOVERNMENT EFFICIENCY COMMISSION LED BY ELON MUSK

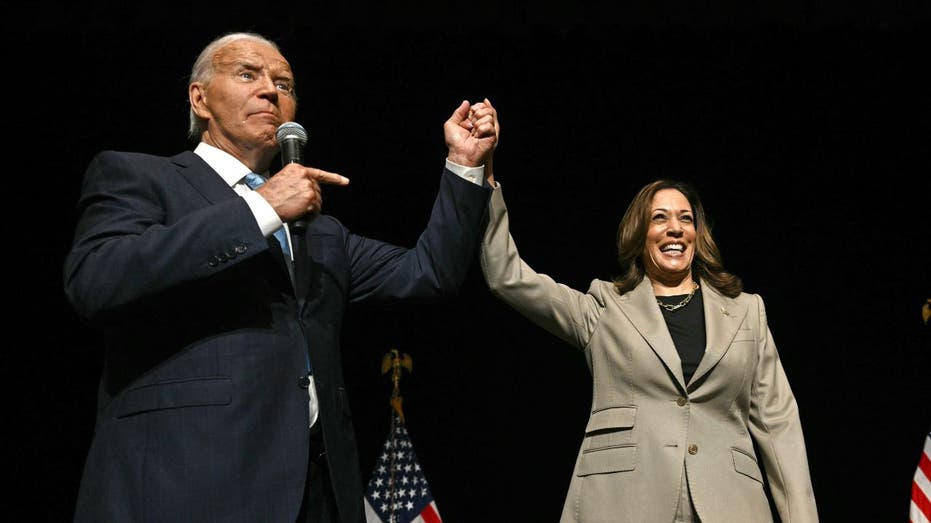

Harris’s proposal for a lower top tax rate on capital gains suggests she wants to appeal to a broader base of voters even as she sticks with most of Biden’s plans to strengthen the middle class. Harris became the Democratic nominee after Biden stepped aside on July 21.

In his fiscal 2025 budget, Biden had proposed raising the tax rate on long-term capital gains – the profits made from selling or trading an asset held for more than a year – to 39.6% for those earning over $1 million annually, from the current rates, which range up to 20%, depending on income.

THE KAMALA HARRIS TAX PLAN

Harris said she also plans to offer low- and no-interest loans to small businesses, cut the red tape they face and expand access to venture capital.

She said she supported a minimum tax for billionaires proposed by Biden, adding, “It is not right that those who can afford it are often paying a lower tax rate than our teachers and our nurses and our firefighters.”

Reuters contributed to this report.

Read the full article here