Intel Corp. was once the most valuable semiconductor company in the world, but the chipmaker’s steady decline in recent years has put it in a vulnerable spot.

The company, which is now worth less than half its value from three years ago, has now reportedly become a takeover target after being approached recently by Qualcomm with an acquisition offer, according to multiple reports.

According to The Wall Street Journal, which first reported the takeover bid, a series of missteps by Intel have led to the company’s weakened position, including the company’s failure to anticipate how the rise of artificial intelligence would reshape the industry.

“Over the past two to three years, the shift to AI was really the nail in the coffin for them,” CFRA Research analyst Angelo Zino told the outlet. “They just didn’t have the right capabilities.”

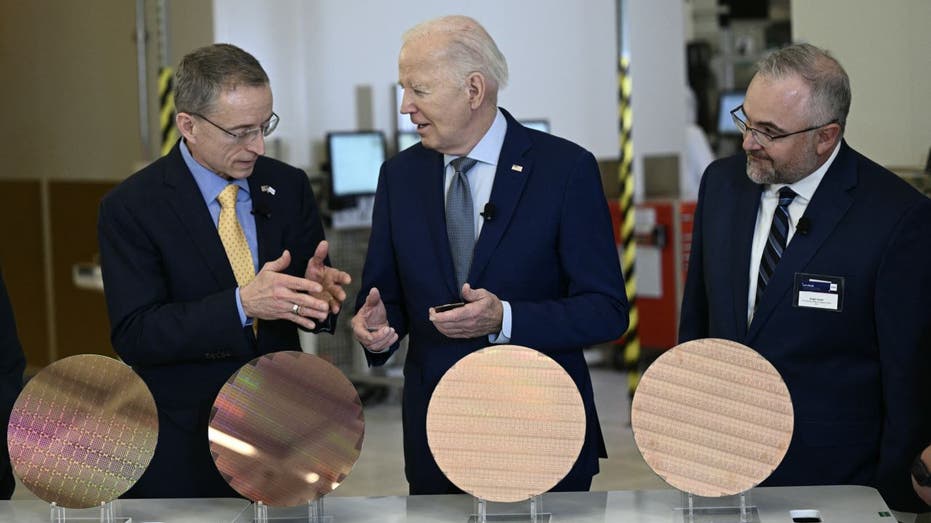

INTEL’S FINANCIAL STRUGGLES THREATEN BIDEN ADMIN CHIP STRATEGY

Once the dominant force in chipmaking, Intel ceded its manufacturing edge to Taiwanese rival TSMC and failed to produce a widely desired chip for the generative AI boom capitalized on by Nvidia and AMD.

Intel has been attempting to turn its business around by focusing on AI processors and creating a chip contract manufacturing business, known as a foundry. But the company has faced headwinds in both those endeavors.

The U.S.-based chipmaker was expected to be the chief beneficiary of the tens of billions in taxpayer subsidies allocated under the bipartisan CHIPS and Science Act passed two years ago. But so far, the company has not received any funds as it works to meet the government’s requirements, and instead of creating the jobs promised under the policy, it has slashed its workforce by 15%.

Then earlier this month, Reuters reported that, according to three sources familiar with the matter, Intel suffered a setback in its contract manufacturing with recent failures of its most advanced chip-making process.

INTEL HAS ITS ‘WORK CUT OUT’ DESPITE LAUNCH OF NEW CHIPS: BETH KINDIG

As part of a memo from CEO Pat Gelsinger, Intel released a series of announcements that stemmed from a board meeting last week. Gelsinger and other executives presented a plan to shave off businesses and restructure the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| INTC | INTEL CORP. | 22.53 | +0.69 | +3.16% |

The company plans to pause construction on factories in Poland and Germany, and reduce its real estate holdings. Intel also said it had reached a deal to make a custom networking chip for Amazon’s AWS.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Meanwhile, Intel’s stock is down nearly 60% year to date, but ended up 3.3% on Friday with a boost following the Journal’s report of Qualcomm’s potential bid.

Reuters contributed to this report.

Read the full article here