This article was originally published by Tyler Durden at ZeroHedge.

In a fascinating geopolitical development, Bloomberg reports that Saudi Arabia privately hinted earlier this year it would sell some (or all) of its European debt holdings if the G-7 confiscated Russia’s frozen assets.

As a reminder, we noted in May the European Union had approved a US-backed plan to use profits and interest generated from Russian assets to help arm Ukraine; however, that was a sharp reversal from the previously proposed plan – one which was heavily promoted by Zelensky and Ukraine – to confiscate some $300 billion in Russian assets. Many were wondering what prompted the reversal.

Now we know, and as Bloomberg notes “the Kingdom’s finance ministry told some G-7 counterparts of its opposition to the idea, which was meant to support Ukraine, with one person describing it as a veiled threat.” The Saudis specifically mentioned debt issued by the French treasury, two of the people said.

Most of the $300 billion in frozen Russian assets are held in Europe – particularly France, Germany, and Belgium. This makes today’s report from Bloomberg even more interesting from a geopolitical fissures perspective, as it means that as a result of its ability to spark a liquidation panic in Europe’s unstable bond market, it has far more leverage than Ukraine and the “virtue signaling” Western media.

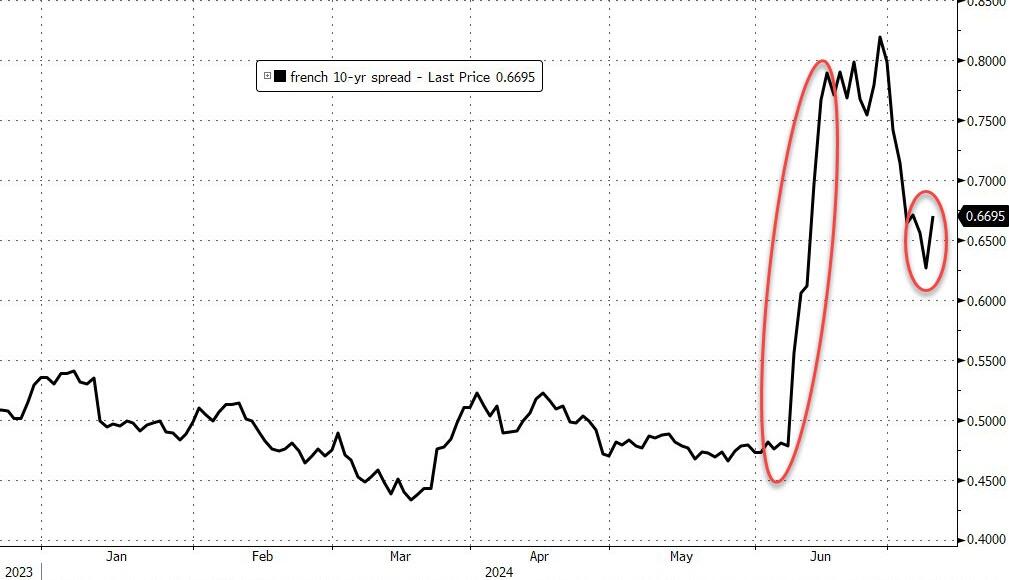

Now, notably, Macron called an election and that election swung wildly to the far-left in the interim, but since these ‘talks’ happened with the Saudis, French bond yield spreads to Germany have exploded wider…

Surely this selling panic coming at a time when the Saudis are using French bonds as political leverage, was just a coincidence.

Curiously, while Saudi Arabia has maintained strong relations with Moscow, it has also built ties with Ukraine. And yet, it is clear that when push comes to shove, the Crown Prince is firmly in Putin’s corner.

Bloomberg concludes by noting that whatever its motive, Saudi Arabia’s move underscores its growing clout on the world stage and the G-7’s difficulty in garnering support from so-called Global South nations for Ukraine.

And the US should know: as a reminder back in April 2016, the NYT reported that Saudi Arabia threatened then-president Barack Obama to liquidate the $750BN in US Treasuries it owned at the time (a move which would have spawned a bond market crash) if it was found responsible for the Sept 11 attacks

Then – like now – the Saudis won (amusingly, Saudi Arabia proceeded to slash its TSY holdings in half by the end of 2016 anyway). But the bigger point here is two-fold:

- While the petrodollar may or may not be dead, its leverage is a pale shadow of its former self; in fact, the only leverage goes to those who still own US paper, and can threaten to dump it at will.

- Weaponizing the US dollar – as irrelevant as it may now be – against Russia was a catastrophic decision that will reverberate for years, and will force the Fed to eventually buy up all the US debt that the former holders of Treasuries will one way or another sell.

Read the full article here